“We are the addicts, the oil producers are the pushers.”

Thomas Friedman

A big hello to regular readers, and a warm welcome to our new subscribers. We’ll kick things off with a look over last week, before jumping into what lies ahead!

Weekly Performances

US Indices

S&P500 4515.50 +110 (+2.50%)

Nasdaq 15490 +549 (+3.67%)

Dow 34838 +491 (+1.43%)

Russell 1920.8 +67 (+3.63%)

Magnificent 7

Microsoft 328.66 +5.68 (+1.76%)

Apple 189.46 +10.85 (+6.07%)

Google 136.80 +6.11 (+4.68%)

Meta 296.38 +10.88 (+3.81%)

Amazon 138.12 +4.86 (+3.65%)

Tesla 245.01 +6.42 (+2.69%)

Treasury Bond Yields

2-Year 4.881% -0.1999

5-Year 2.299% -0.141

10-Year 4.181% -0.058

Currencies

Dollar Index 104.26 +0.076 (+0.07%)

Dollar/Yuan 7.2601 -0.0287 (-0.39%)

Dollar/Yen 1.46.247 -0.131 (-0.09%)

Euro/Dollar 1.07731 -0.002 (-0.20%)

Commodities

WTI Crude 85.55 +5.72 (+7.17%)

HG Copper 3.852 +0.09 (+2.39%)

Spot Gold 1939.90 +25.45 (+1.33%)

Spot Silver 24.180 -0.045 (-0.18%)

Economic Data

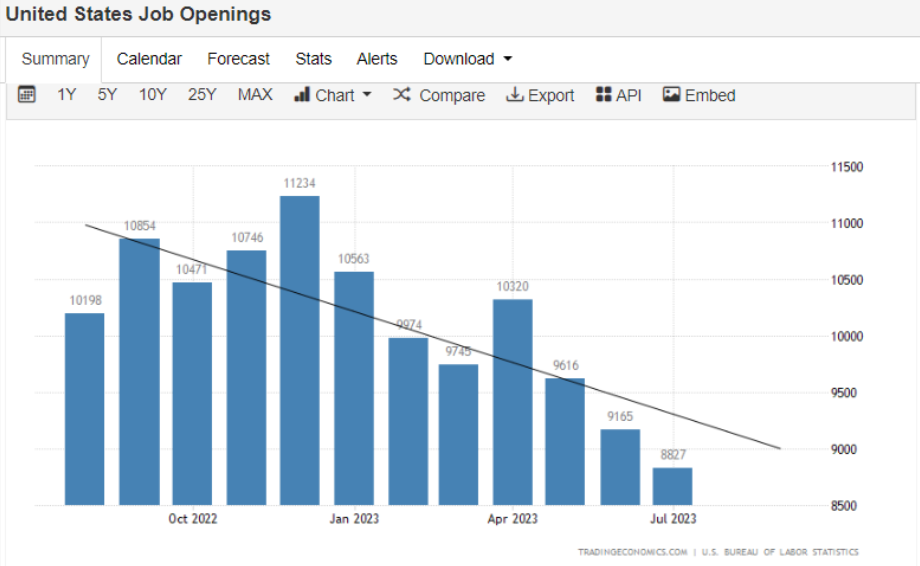

A solid performance from big-tech stocks propelled US indices to their best 5-day winning streak in over two months, erasing most of the losses suffered in the first half of the month (although still down in August). Perversely, most of last week’s gains followed the terrible JOLTs job openings data on Wednesday (read more here).

Following the outsized reaction to Wednesday’s massive JOLTs miss, confusion was high ahead of the more significant (and far less believable) nonfarm payroll data on Friday, with analysts expecting anywhere from 40k to 275k new jobs added in August.

The NFP came in at 187k, slightly above consensus expectations of 170k. Except if probably didn’t, because we all know that the Bureau of Labour and Statistics (BLS…but we should probably drop the L) will revise the August data lower, just as they have with every reading this year.

While they can try (and fail) to pull the wool over our eyes by manipulating the NFP, the jump in the unemployment rate from 3.5% to an 18-month high of 3.8% tells us everything we need to know — the lagging effects of rate hikes are starting to take a toll on the labour market.

The optimists out there will tell you this is exactly what the Fed is hoping for, and that a softening labour market means no more rate hikes. But be careful what you wish for because when unemployment turns higher, a recession is usually not far behind.

In the next sections, we’ll run through the key technical levels on US indices and share our insights on what implied volatility, positioning, and investor sentiment mean for markets this week. then we’ll wrap things up with our analysis of two commodities that are gearing up for massive moves.

Keep reading with a 7-day free trial

Subscribe to Trading Floor Whispers to keep reading this post and get 7 days of free access to the full post archives.