Your best work involves timing. If someone wrote the best hip-hop song of all time in the Middle Ages, he had bad timing.

-Scott Adams

Last Week: Stocks dump after Nvidia’s massive earnings beat

This week: Stocks pump after US Jobs openings crater

The S&P and Nasdaq surged to their best trading days in over four months yesterday on news that <checks notes> the US economy is going down the toilet.

Yes folks we are back in the upside down, where the crappier the data, the bigger the rally. Why? Because if the economy stalls then maybe the Fed will stop raising rates. Even better, if we get a recession they’ll probably cut rates, and that worked out great for stocks in 2000 and 2007.

JOLTed

Wall Street was expecting a modest drop in the July job openings from 9.582 million to 9.5 million, supporting the soft-landing the Fed is so desperately trying to engineer. Instead, they got the third-biggest miss ever and the first

Sub-9 million print in over 2 years.

In the last three months, more than 1.5 million job openings have disappeared. If you are wondering if that’s bad, it’s the second highest on record, surpassed only by 2020 when the whole country was literally under house arrest. So yeah, it’s beyond bad. What’s worse is that the JOLTs’ numbers are a lagging indicator. The current reality could be way worse.

To see a JOLTS report show declines in openings, hires and quits and an increase in layoffs is a 4 SD event. It has happened a total of 4% of the time in the past and just 2% when the economy was not in a recessionary state (maybe it is!).

David Rosenberg

So to get this straight. The Fed tried to generate inflation in 2020 and 2021 but lost control in 2022. And now they are trying to tame inflation by generating unemployment, but are confident they won’t lose control of unemployment.

Just as we’ve been warning, the lagging effect of rate hikes is starting to crack the labour market. So how much more damage can we expect in the coming months? And how long can stocks ignore the fact that the economy is slowing much faster than predicted? History suggests, not for too long!

Following the “dovish” jobs data, US bond yields fell sharply and the Dollar Index slid -0.50% to its worst day in two months, both fueling the risk-on appetite for stocks.

The fall in yields provided substantial energy for stocks, with the S&P making light work of the horizontal resistance at 4450 and the 50-DMA at 4461. Furthermore, the index clawed its way back into the rising trend channel.

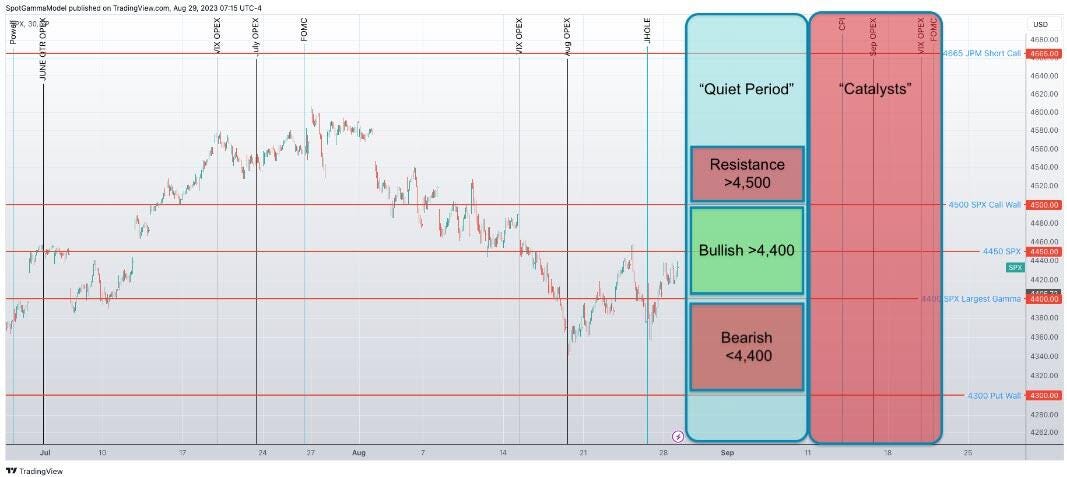

However, the move stalled (so far) at the massive 4500 call option strike which offers significant resistance. As we mentioned on Monday, the dealer gamma flips positive above 4500 (selling into strength) so further gains will be much harder fought.

Market outlook based on option hedging flows.

Summary

Piss poor economic data is exactly that and shouldn’t be confused as a contrarian buy signal. Although the immediate to yesterday’s jobs data reaction is bullish, the longer-term implications are far from.

Don’t forget that liquidity is incredibly low at the moment and dealer positioning was short. Both of those contributed to yesterday’s outsized reaction. Which is exactly as we foretold on Monday.

According to Goldman, dealers will need to sell -$2.5B worth of gamma per every 1% move lower in the SPX. But it’s important to remember this swings both ways. The more sold into weakness means more to buy if the market turns higher, which might explain some of the erratic moves from last week.

That same negative gamma is still sitting below the market. So don’t be surprised if yesterday’s gain turns into today’s pain. Am I less bearish than Monday? Hell no…if anything I’m even more negative. But this game is all about timing, so stay tuned for my top short trades for September out tomorrow!

As always, thanks for reading, and good luck out there.

Elliott.

Hi Patrick...

I wrote about it in previous posts. But I'll write a post explaining it in greater detail on Sunday. Thanks for commenting, I always appreciate feedback.

Have a great day

Did you explain this Gamma thing in the past? I do not really understand it yet and would love to dive into it more.