Powell Flip Flop Ignites Historic Call Buying Frenzy as FOMO Returns With A Bang

Long Story Short, F*ck My Shorts

I’d love to know what changed from the last FOMC for Powell to go from:

“It’s premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy night ease”

To then warn us that rate cuts “begin to come into view, and are clearly a topic of discussion.’

Could it be that Powell is buckling to political pressure from the big guy, who’ll gladly ignite animal spirits to secure another four years of backhanders?

Most likely it’s because JPow sees what’s clear to the rest of us: The fastest hiking cycle in four decades will result in a hard landing for the US economy. Whatever the reason for Powell’s about-turn, markets went haywire, with dollar-sign-eyed punters piling into the poorest-performing asset classes of the last two years (unprofitable Tech and cryptocurrencies).

Why? Because the Fed has greenlit another speculative mania just in time for your spotty basement-dwelling nephew to shill you the benefits of BonkCoin (+18,000% since October) over the Festivities.

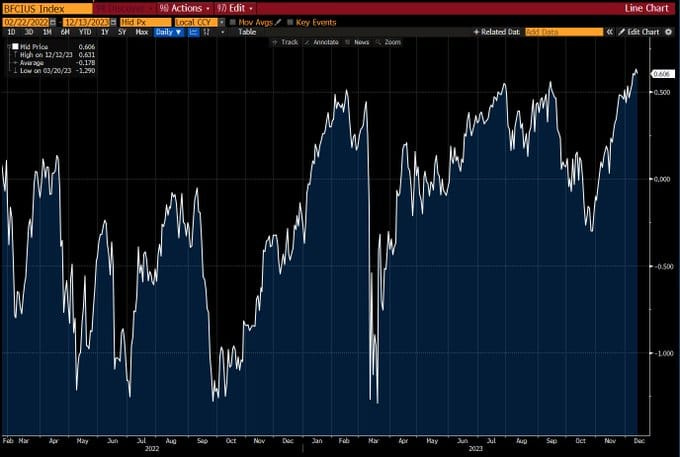

Maybe I’m bitter because my shorts were decimated last week. Although the long Russell call was epic if I do say so myself (+8.55%). But, Bloomberg’s financial conditions index shows money is looser now than before the hiking cycle. In other words, it’s as though the Fed never raised rates at all — That’s what’s confusing.

While I do agree that inflation is under control, it’s still running at twice the Fed target rate. Should we not be waiting a few months before declaring victory? Why, when given the chance, did Powell not temper expectations? Is the Fed rightly eyeing the economic carnage in Europe and China and trying to get a head start on a possible deflationary cycle at some stage?

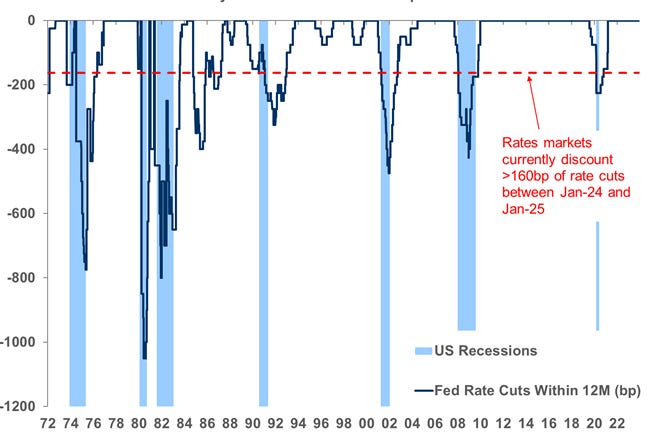

Honestly, I’m lost as to where the all-seeing central bankers are going with this. But at one stage last week, the market was pricing 160 basis points of cuts in 2024. Have a quick gander at the chart below and ask yourself if that’s a good thing.

The Dash for Trash Goes Bezerk

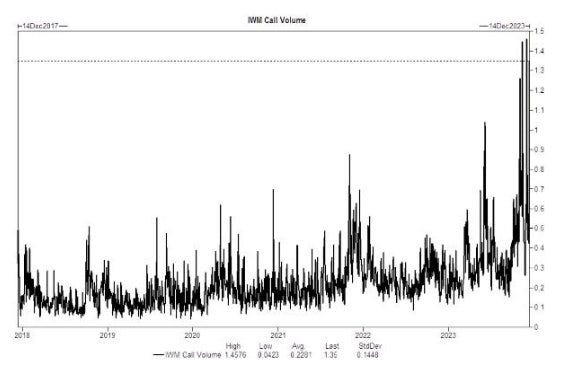

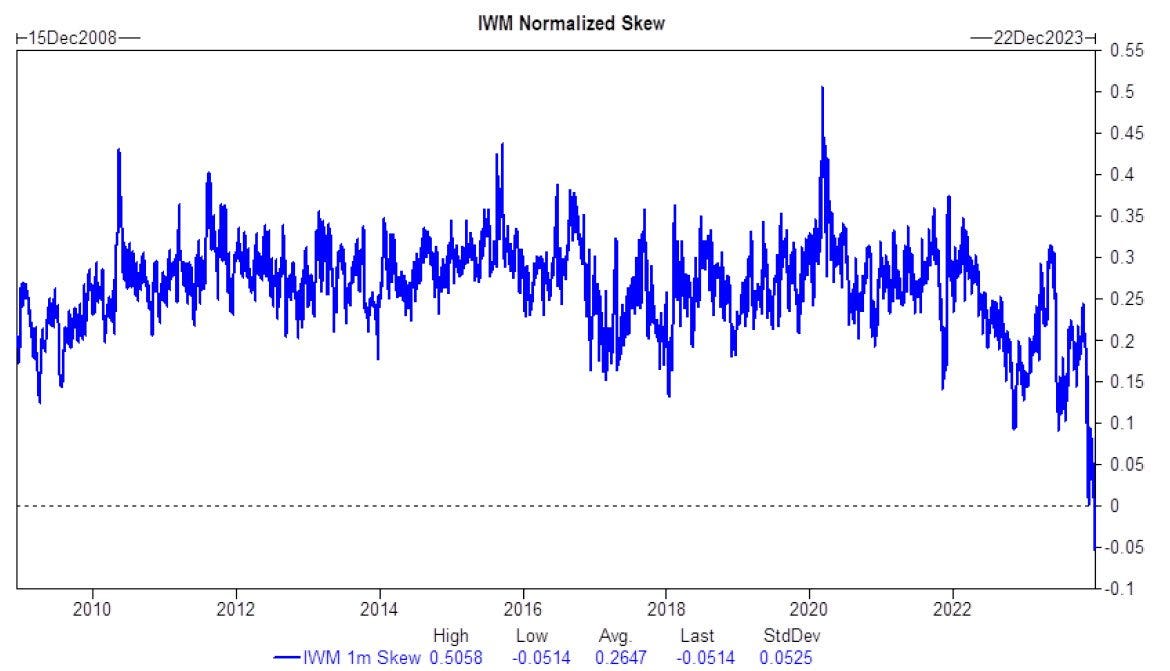

The Fed’s ‘pivot’ last week sent FOMO call buyers insane. There were over 42m call options traded during Thursday — the highest daily call volume of all time. Notably, the demand for call options on the IWn was off the charts (chart 1). Subsequently, the options skew has inverted by the most on record, signalling historic demand for calls over outs (chart 2).

While I wish the retail crowd luck, the IWM is trading at the top end of the 18-month trend channel. Above that, the chase may truly be on. However, another weekly close below $202 could mark the start of a reversal. For this reason, I am closing the long IWM recommendation for now, with a view of re-entering on clearance of $202, or a pullback towards $186.

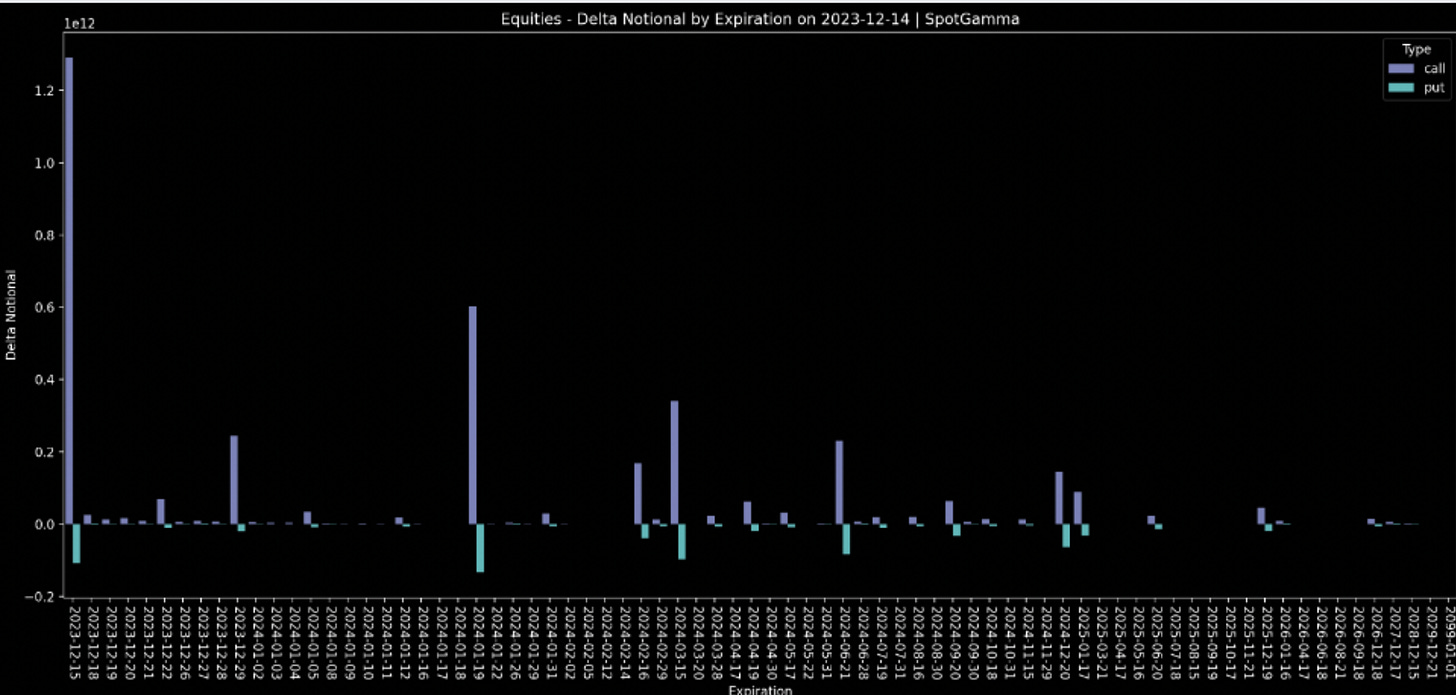

Another thing I’m watching is how the market reacts to last week’s mammoth options expiration. As of Friday’s close, options of around $3.3 Trillion of notional are no more. As a result, around $1.3 trillion of call delta no longer needs to be hedged by market-makers. This clears out a lot of the dip-buying evident last week. Which, by no means signals imminent correction, but does allow the market to move more freely.

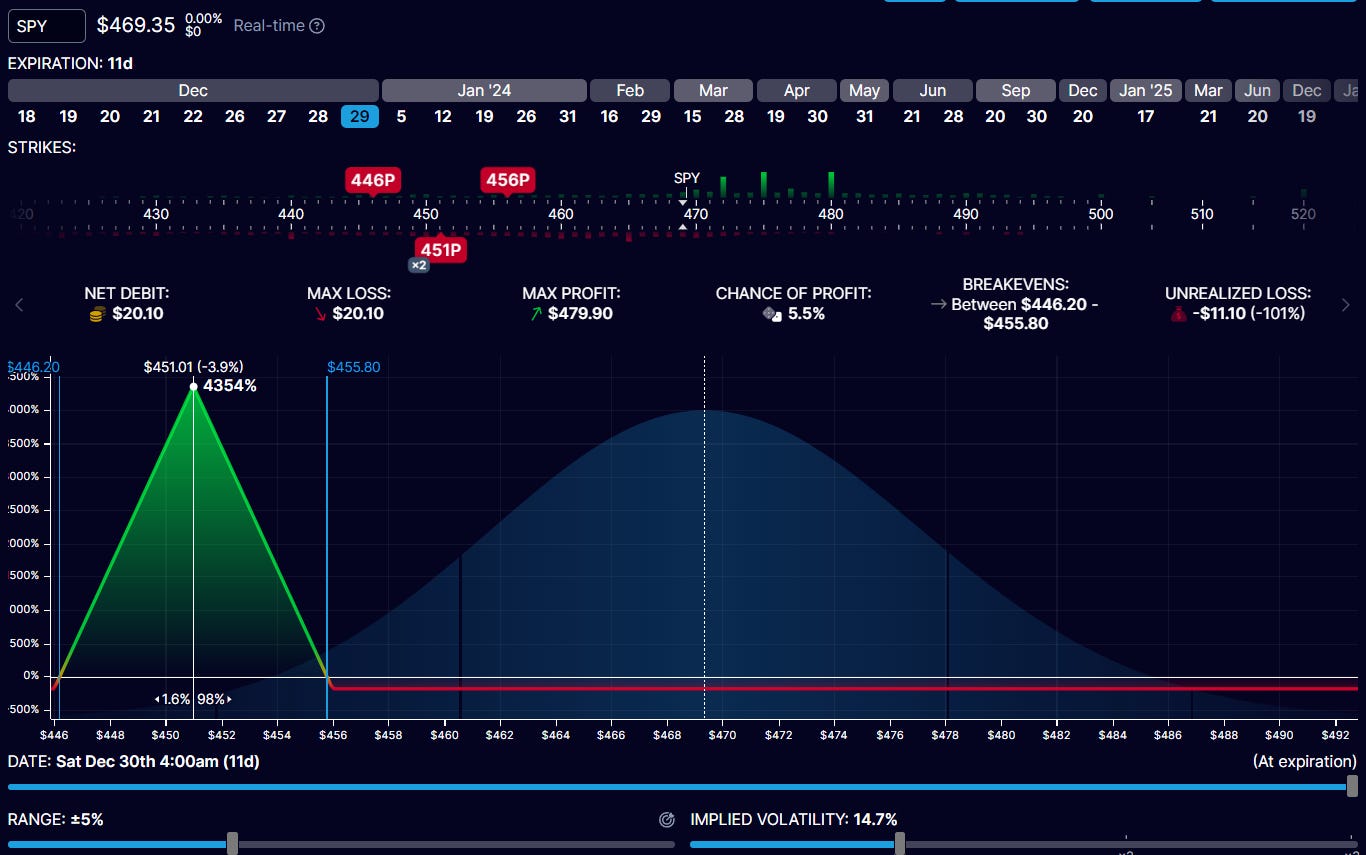

With that in mind, I wonder if the massive JP Morgan $4,515 call strike expiring 12/29 could come into play for year-end. While it seems unlikely right now, stranger things have happened. After all, this time last year, the SPX dropped 8% from Dec 13 to Dec 22, ending the year glued to the closest JPM Strike.

Will history repeat? Probably not. But with indices stretched into the nosebleeds, I’m prepared to risk $20 per contract for a potential 4,300% return.

Here’s an Xmas lottery idea on SPY (1/10 SPX price roughly)

Long Put Butterfly

Buy 1x Dec 29 $456 put

Sell 2x Dec 29 $451 put

Buy 1x Dec 29 $446 put

max Risk: $20

Max Profit $473 (4,330%)

Indices are Dangerously Overbought.

Yes, markets can stay irrational for longer than we can remain solvent, but buying when the RSI is >70 is a -EV trade. I’ll say it again, an overbought RSI is not a sell-signal, but it’s a bloody good ‘don’t buy’ here’ signal in my experience.

S&P RSI = 79

QQQ RSI = 76

Too Bearish? Well here’s a Stock I think Could be in For a Bumper Week

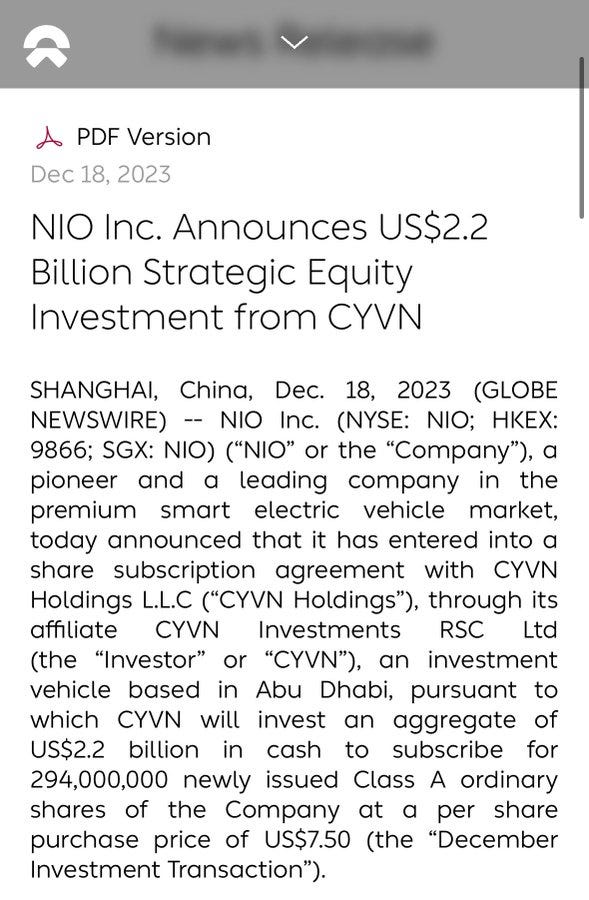

I’ve been a long-time bear on NIO since forever. But even I have to admit that news out over the weekend could be a game-changer for the share price.

NIO ($NIO) CEO Li Bin just successfully live-streamed a 1000km ride in an ET7 with a Hybrid Solid State Battery, with 916 km driven on NIO pilot. Impressively the battery still had 7% of charge left.

Full Story Here

And then there’s this…

Taking these into consideration alongside the current climate of chasing losers, I think NIO could have some serious upside from here. However, the stock is currently up around 8.5% premarket at $8.35. I’ve added a new (small) speculative long at that level with a view to closing should we breach the $7.00 support. As for a price target…who knows in this environment? But the risk vs. reward looks very attractive here.

As always guys, thanks for ready and good luck out there.

Elliott.