Nvidia stock pukes 10% on Friday, to the same price as <checks notes> Wednesday

So goes Nvidia, goes the market

⁕⁕Nividia loses $250 billion in market cap in 30 minutes⁕⁕

It was only a matter of time before Nvidia gave the market a gentle reminder that chasing parabolic rallies is probably not the smartest move, but perspective is everything. While Friday’s sudden reversal undoubtedly bloodied the noses of a few over enthusiastic latecomers, the chipmaker still ended the week $50 higher (+6.30%). That being said, a $2.3 trillion company trading like a meme coin tells me that anxiety is running high. What’s more, considering how dependent the market is on Nvidia, a repeat of Friday could spark a full on panic-attack.

Considering that march 10, 2000, was the pico-top of the original tech bubble in 2000, it would certainly be ironic if friday was the top (for now at least). But just how likely is that, and what would it mean for the market at large? Here’s our take….

Breaking down the move

From a technical analysis perspective, Friday’s engulfing bearish candle was ugly to say the least. To close right on the lows after making a new all-time high, accompanied by massive trading volume could be indicative of shorts capitulating into a blow-off top. It’s not so much the magnitude of the drop (NVDA added $250b in market cap from Wednesday morning to friday’s high), more how it arrived there.

Why Friday's big red candle is concerning — Leverage

Why settle for buying a stock that goes up 5% every day when you can make 10% a day using leverage? Because it’s borderline insanity, that’s why!

In December 2022 GraniteShares launched a "2X Long Nvidia" ETF (NVDL), structured to return 200% of the price of NVDA. As this cumulative flow chart below shows, the inflows into the ETF were pretty timid up until the end of January this year. However, since February almost $600m has piled in (data doesn’t include last week).

The problem with leveraged products is that the leverage works both ways. Whereas Nvidia stock pulled back 10% from the intraday high and closed down 5.50%, the 2x levered NVDL plunged 20% and closed down 11%. Taking into account that the majority of buying happened in the last few weeks, another leg lower could encourage a second bout of forced liquidation.

leverage isn’t the only thing that goes both ways, so does negative gamma.

Regular readers will know that market maker gamma exposure is something I monitor closely. Why? Because my experience as an options MM taught me that the hedging flows from options MMs buying and selling the underlying asset to hedge their directional exposure are some of the largest non-discretionary flows in the market.

Recently, the amount of call options being bought in Nvidia has surged to an all-time high. Seeing as a long call option is a bullish trade, the market makers selling those call options inherit a bearish trade. To hedge these bearish trades, MMs buy the underlying shares equal to the delta of the options. However, options are convex instruments, so as the share price moves higher, the delta of the call options acclerates (Gamma measures the acceleration of delta), meaning the dealer short position grows larger. As such, they need to buy increasingly more shares to hedge their short call positions. However, if the price turns lower, dealers will be forced to dump their recently bought shares back onto the market.

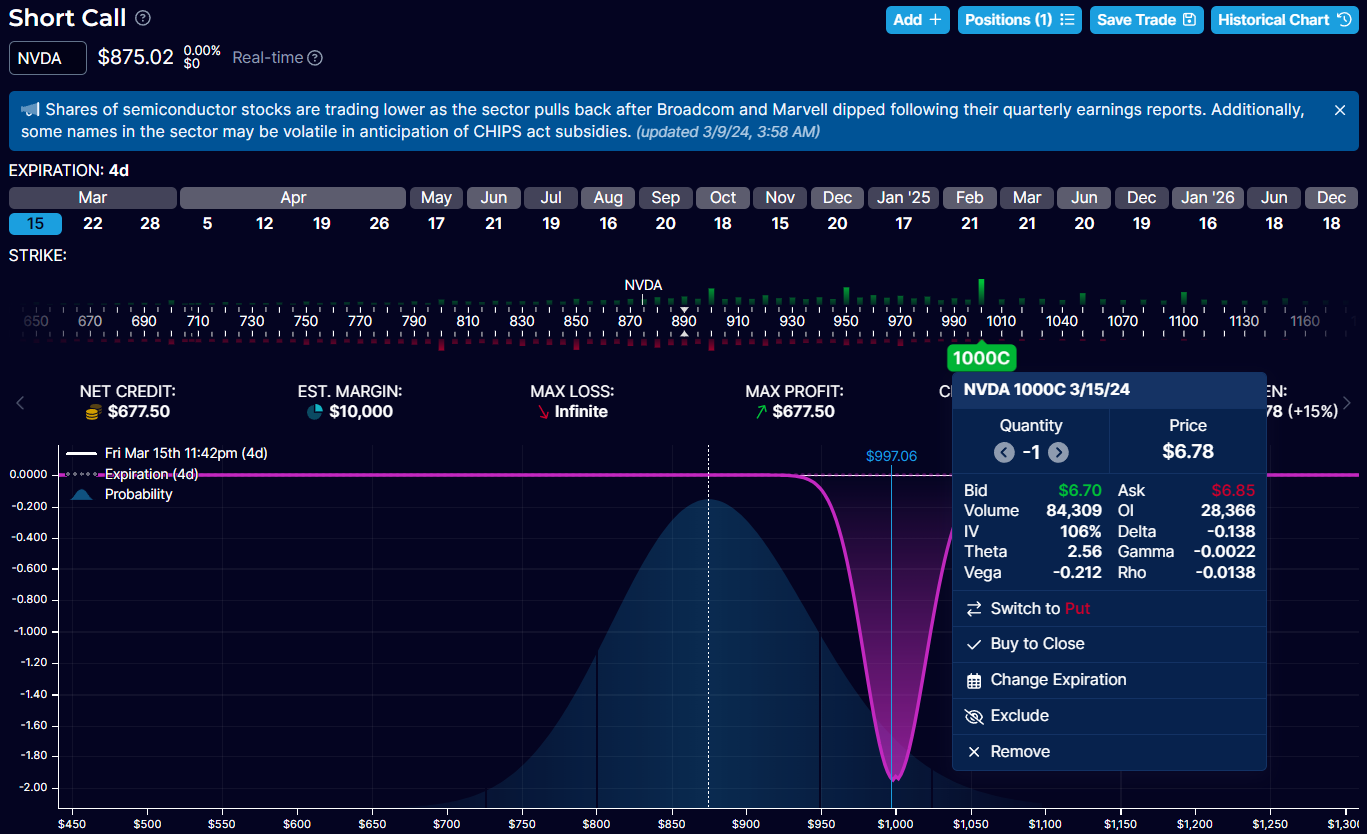

The thing to know about options gamma, is that it’s highest for at-the-money options (strike price is equal to the underlying share price) that are approching expiration. To simplify things, lets look at the strike with the largest open interest for this Frida’s monthly expiration.

On Friday, the $1000 call option had the largest open interest (largest gamma). Subsequently, dealers would have buying frantically at the start of the day, and doing the opposite in the afternoon.

Open interest and Gamma Exposure for march 15 $1000 call

Simply, the lower the market goes, the less stock dealers will need to hold to hedge their upside exposure. Furthermore, if the market switches from buying calls to buying puts, dealers will need to sell even more stock. However, as long as that large open interest remains above the market, dealers will be forced to rebuy stock if the price turns higher again. Nonetheless, the pain trade is definitely lower….

If leveraged positions continue to bail this week, it could trigger a move lower in the stock, aided by agressive selling from market makers. Considering that Nvidia is almost singlehandedly responsible for the good start that indices have had year-to-date, a sell-off could spell big trouble for the marklet at large.

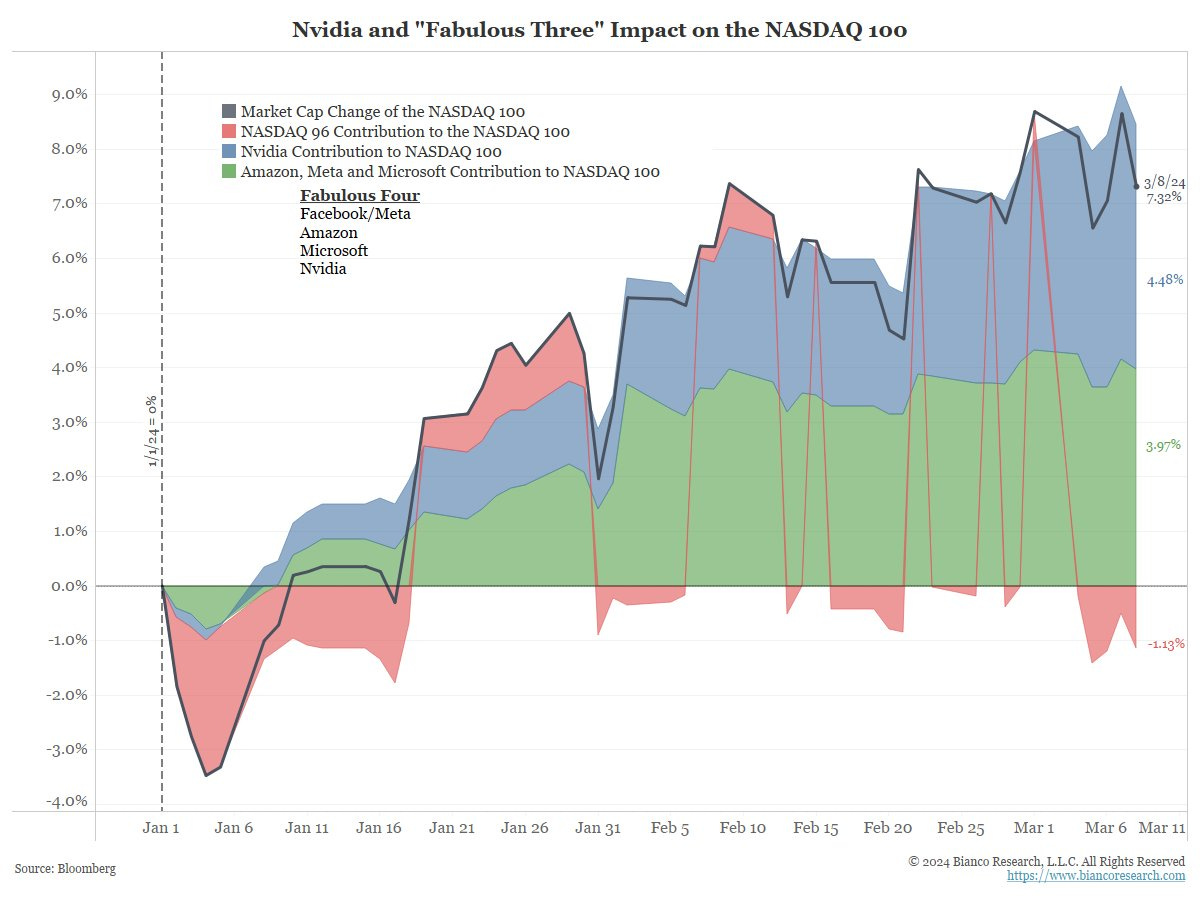

As this chart shows, Nvidia is responsible for around a third (blue) of the icrease in the S&P 500's market cap (black line) this year.

And over 60% of the NASDAQ’s (black line).

What’s the trade?

If you are asking yourself if now is the time to short Nvidia, I have some sage advice for you. Go have a lie down, and don’t get up until that feeling has gone. I mean, if you are long the stock, now seems a good a time as any to lovk in some porfits (assuming you bought before Wednesday), but other than that, leave it well alone. Just use it as a barometer for the overall prospects of the market. After all, if it goes down, so will the SPY, QQQ and almost ecverything else, and they are much safer plays out there.

Here’s what im doing……nada, zip, zilch. Well certainly not until after tomoroow’s CPI print. However tempted I am to bash the sell button here, there’s enough meat on the bone to wait and see if the inflation data supports a bearish view.

As always, thanks for reading and good luck out there.

Elliott.