Goldman Sachs Calls BS on the AI Bubble

Do I smell tulips?

“Reflexivity refers to the self-reinforcing effect of market sentiment, whereby rising prices attract buyers whose actions drive prices higher still until the process becomes unsustainable. This is an instance of a positive feedback loop. The same process can operate in reverse leading to a catastrophic collapse in prices.”

Ever since the Fed flooded the world with cheap dollars in response to the Covid pandemic, asset bubbles have been two-a-penny. In just a few short years, we’ve seen boom and bust cycles in crypto, the metaverse, space tourism, and even fake meat. While the assets are diverse, they all share one thing in common: Massive wealth creation for the lucky punters who knew when to get out, and the opposite for those who didn’t.

This week, investment bank Goldman Sachs says we are in the grips of yet another bubble. Of course, they are talking about AI.

In the most recent top-of-mind report, the bank asks whether the expected

$1 Trillion investment in AI over the next few years will face the same fate as the billions invested into Web 3.0 and the like.

Logically, you’d expect the Vampire Squid to be vigorously bullish. After all, more capital flowing into the space means more M&A, more IPOs, and more investment banking fees. Instead, Jim Covello, Goldman’s Global Head of Equity Research says the market is way too optimistic about AI, and the fallout could be (will be) catastrophic.

The full interview with Top-of-Mind Auther Allison Nathan (Long, but a must-read).

Allison Nathan: You haven’t bought into the current generative AI enthusiasm nearly as much as many others. Why is that?

Jim Covello: My main concern is that the substantial cost to develop and run AI technology means that AI applications must solve extremely complex and important problems for enterprises to earn an appropriate return on investment (ROI). We estimate that the AI infrastructure buildout will cost over $1tn in the next several years alone, which includes spending on data centers, utilities, and applications. So, the crucial question is: What $1tn problem will AI solve? Replacing low-wage jobs with tremendously costly technology is basically the polar opposite of the prior technology transitions I’ve witnessed in my thirty years of closely following the tech industry.

Many people attempt to compare AI today to the early days of the internet. But even in its infancy, the internet was a low-cost technology solution that enabled e-commerce to replace costly incumbent solutions. Amazon could sell books at a lower cost than Barnes & Noble because it didn’t have to maintain costly brick-and-mortar locations. Fast forward three decades, and Web 2.0 is still providing cheaper solutions that are disrupting more expensive solutions, such as Uber displacing limousine services. While the question of whether AI technology will ever deliver on the promise many people are excited about today is certainly debatable, the less debatable point is that AI technology is exceptionally expensive, and to justify those costs, the technology must be able to solve complex problems, which it isn’t designed to do.

Allison Nathan: Even if AI technology is expensive today, isn’t it often the case that technology costs decline dramatically as the technology evolves?

Jim Covello: The idea that technology typically starts out expensive before becoming cheaper is revisionist history. Ecommerce, as we just discussed, was cheaper from day one, not ten years down the road. But even beyond that misconception, the tech world is too complacent in its assumption that AI costs will decline substantially over time. Moore’s law in chips that enabled the smaller, faster, cheaper paradigm driving the history of technological innovation only proved true because competitors to Intel, like Advanced Micro Devices, forced Intel and others to reduce costs and innovate over time to remain competitive.

Today, Nvidia is the only company currently capable of producing the GPUs that power AI. Some people believe that competitors to Nvidia from within the semiconductor industry or from the hyperscalers—Google, Amazon, and Microsoft— themselves will emerge, which is possible. But that's a big leap from where we are today given that chip companies have tried and failed to dethrone Nvidia from its dominant GPU position for the last 10 years. Technology can be so difficult to replicate that no competitors are able to do so, allowing companies to maintain their monopoly and pricing power. For example, Advanced Semiconductor Materials Lithography (ASML) remains the only company in the world able to produce leading edge lithography tools and, as a result, the cost of their machines has increased from tens of millions of dollars twenty years ago to, in some cases, hundreds of millions of dollars today. Nvidia may not follow that pattern, and the scale in dollars is different, but the market is too complacent about the certainty of cost declines.

The starting point for costs is also so high that even if costs decline, they would have to do so dramatically to make automating tasks with AI affordable. People point to the enormous cost decline in servers within a few years of their inception in the late 1990s, but the number of $64,000 Sun Microsystems servers required to power the internet technology transition in the late 1990s pales in comparison to the number of expensive chips required to power the AI transition today, even without including the replacement of the power grid and other costs necessary to support this transition that on their own are enormously expensive.

Allison Nathan: Are you just concerned about the cost of AI technology, or are you also skeptical about its ultimate transformative potential?

Jim Covello: I’m skeptical about both. Many people seem to believe that AI will be the most important technological invention of their lifetime, but I don’t agree given the extent to which the internet, cell phones, and laptops have fundamentally transformed our daily lives, enabling us to do things never before possible, like make calls, compute and shop from anywhere. Currently, AI has shown the most promise in making existing processes—like coding—more efficient, although estimates of even these efficiency improvements have declined, and the cost of utilizing the technology to solve tasks is much higher than existing methods. For example, we’ve found that AI can update historical data in our company models more quickly than doing so manually, but at six times the cost.

More broadly, people generally substantially overestimate what the technology is capable of today. In our experience, even basic summarization tasks often yield illegible and nonsensical results. This is not a matter of just some tweaks being required here and there; despite its expensive price tag, the technology is nowhere near where it needs to be in order to be useful for even such basic tasks. And I struggle to believe that the technology will ever achieve the cognitive reasoning required to substantially augment or replace human interactions. Humans add the most value to complex tasks by identifying and understanding outliers and nuance in a way that it is difficult to imagine a model trained on historical data would ever be able to do.

Allison Nathan: But wasn’t the transformative potential of the technologies you mentioned difficult to predict early on? So, why are you confident that AI won't eventually prove to be just as—or even more—transformative?

Jim Covello: The idea that the transformative potential of the internet and smartphones wasn’t understood early on is false. I was a semiconductor analyst when smartphones were first introduced and sat through literally hundreds of presentations in the early 2000s about the future of the smartphone and its functionality, with much of it playing out just as the industry had expected. One example was the integration of GPS into smartphones, which wasn’t yet ready for prime time but was predicted to replace the clunky GPS systems commonly found in rental cars at the time. The roadmap on what other technologies would eventually be able to do also existed at their inception. No comparable roadmap exists today. AI bulls seem to just trust that use cases will proliferate as the technology evolves. But eighteen months after the introduction of generative AI to the world, not one truly transformative—let alone cost-effective—application has been found.

Allison Nathan: Even if the benefits and the returns never justify the costs, do companies have any other choice but to pursue AI strategies given the competitive pressures?

Jim Covello: The big tech companies have no choice but to engage in the AI arms race right now given the hype around the space and FOMO, so the massive spend on the AI buildout will continue. This is not the first time a tech hype cycle has resulted in spending on technologies that don’t pan out in the end; virtual reality, the metaverse, and blockchain are prime examples of technologies that saw substantial spend but have few—if any—real world applications today. And companies outside of the tech sector also face intense investor pressure to pursue AI strategies even though these strategies have yet to yield results. Some investors have accepted that it may take time for these strategies to pay off, but others aren’t buying that argument. Case in oint: Salesforce, where AI spend is substantial, recently suffered the biggest daily decline in its stock price since the mid-2000s after its Q2 results showed little revenue boost despite this spend.

Allison Nathan: What odds do you place on AI technology ultimately enhancing the revenues of non-tech companies? And even without revenue expansion, could cost savings still pave a path toward multiple expansion?

Jim Covello: I place low odds on AI-related revenue expansion because I don't think the technology is, or will likely be, smart enough to make employees smarter. Even one of the most plausible use cases of AI, improving search functionality, is much more likely to enable employees to find information faster than enable them to find better information. And if AI’s benefits remain largely limited to efficiency improvements, that probably won’t lead to multiple expansion because cost savings just get arbitraged away. If a company can use a robot to improve efficiency, so can the company’s competitors. So, a company won’t be able to charge more or increase margins.

Allison Nathan: What does all of this mean for AI investors over the near term, especially since the “picks and shovels” companies most exposed to the AI infrastructure buildout have already run up so far?

Jim Covello: Since the substantial spend on AI infrastructure will continue despite my skepticism, investors should remain invested in the beneficiaries of this spend, in rank order: Nvidia, utilities and other companies exposed to the coming buildout of the power grid to support AI technology, and the hyperscalers, which are spending substantial money themselves but will also garner incremental revenue from the AI buildout. These companies have indeed already run up substantially, but history suggests that an expensive valuation alone won’t stop a company’s stock price from rising further if the fundamentals that made the company expensive in the first place remain intact. I’ve never seen a stock decline only because it’s expensive—a deterioration in fundamentals is almost always the culprit, and only then does valuation come into play.

Allison Nathan: If your skepticism ultimately proves correct, AI’s fundamental story would fall apart. What would that look like?

Jim Covello: Over-building things the world doesn’t have use for, or is not ready for, typically ends badly. The NASDAQ declined around 70% between the highs of the dot-com boom and the founding of Uber. The bursting of today’s AI bubble may not prove as problematic as the bursting of the dot-com bubble simply because many companies spending money today are better capitalized than the companies spending money back then. But if AI technology ends up having fewer use cases and lower adoption than consensus currently expects, it’s hard to imagine that won’t be problematic for many companies spending on the technology today.

That said, one of the most important lessons I've learned over the past three decades is that bubbles can take a long time to burst. That’s why I recommend remaining invested in AI infrastructure providers. If my skeptical view proves incorrect, these companies will continue to benefit. But even if I’m right, at least they will have generated substantial revenue from the theme that may better position them to adapt and evolve. Allison Nathan: So, what should investors watch for signs that a burst may be approaching?

Jim Covello: How long investors will remain satisfied with the mantra that “if you build it, they will come” remains an open question. The more time that passes without significant AI applications, the more challenging the AI story will become. And my guess is that if important use cases don’t start to become more apparent in the next 12-18 months, investor enthusiasm may begin to fade. But the more important area to watch is corporate profitability. Sustained corporate profitability will allow sustained experimentation with negative ROI projects. As long as corporate profits remain robust, these experiments will keep running. So, I don’t expect companies to scale back spending on AI infrastructure and strategies until we enter a tougher part of the economic cycle, which we don’t expect anytime soon. That said, spending on these experiments will likely be one of the first things to go if and when corporate profitability starts to decline.

Source: Zerohedge

Will the AI Bubble Pop Soon?

It’s almost impossible to determine when an asset bubble will pop. The AI them could blow up spectacularly tomorrow, next year, or not at all. However, you tend to see the same behaviour ‘close’ to market tops:

Wildly Optimistic Expectations

The more superlatives you see thrown around about the immediate benefit of a ‘revolutionary technology’, the more concerned you should be (in the near term). Even when technology is truly transformative, it can take years or decades to justify the market’s early valuations.

Let’s say you bought Amazon stock at the peak of the dot-com bubble, it would have taken 9 years to break even — That’s without considering inflation, interest rates and opportunity cost. If you bought it just 10 months later, your investment would have shown a 2,000% return over the same period.

And a staggering 73,000% over time! Which is fantastic if you didn’t get wiped out in the first crash, and tragic if you did.

One Theme to Rule Them All

In the last year or so, AI stocks have been the only game in town. Subsequently, they are pulling capital from traditionally less-risky areas of the market. This dynamic is unsustainable in the long run, as it requires a never-ending stream of new buyers. Sooner or later, the buying dries up and all that’s left are sellers.

Bears go Extinct

It doesn’t make you very popular being bearish during a bull market for obvious reasons. Most investors are naturally optimistic, and so they should be; The stock market goes up over time. Because of this, many commentators give up their bearish stance to avoid ridicule.

When the last bear dies off, only a self-reinforcing echo chamber of bullishness remains, which only encourages investors to pour money into over-inflated assets.

How to Trade Bubbles

The first rule of ‘Bubble Club’ is to see it for what it is, Absolutely enjoy the ride the ride higher, but understand that at some stage, the ride stops (or at least pauses).

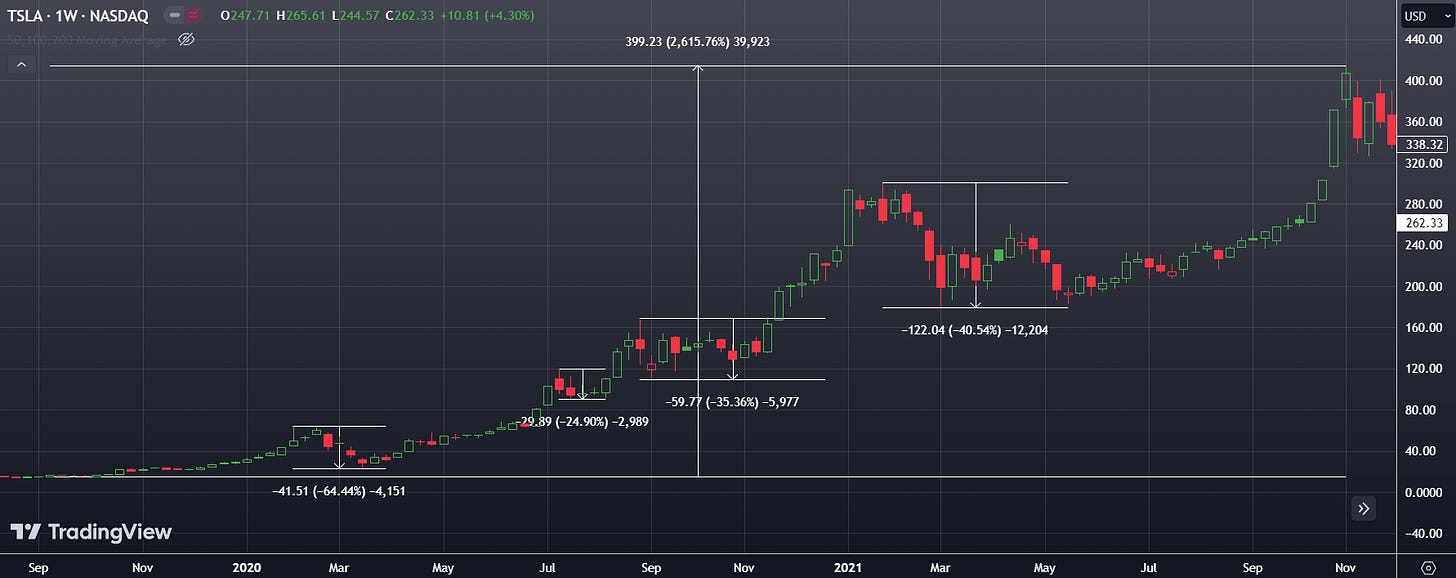

The second rule is don’t invest more than you can afford to lose and never use leverage. Even during Tesla’s epic bull run from 2019-2021, there were four official bear markets (>20% drop).

Trading smaller allows you to ride out uncomfortable corrections and stay in the position for longer. And should an uncomfortable correction morph into something more severe, you’ll live to fight another day.

Rule number three is the most important of all….Sell when you can, not because you have to.

There’s a saying in trading that ‘You never go broke taking a profit.’ But that’s exactly what most investors struggle with. As your profits grow, your exposure grows with it. If you buy 10 shares of a stock trading at $100 and it drops 10%, you lose $100, if the stock doubles to $200, a 10% drop now costs you $200. Considering some AI names have risen between 500%-1000% since last year, now might not be the worst time to take (at least some) money off the table. That way, you’ll still have some skin in the game if the market keeps roaring higher, and some left to deploy on a pullback (or worse).

As always, thanks for reading and good luck out there.

Elliott.

As always, very good advises and great perspective. Thanks Elliott!