FOMC, Nvidia AI conference, Stock buybacks — What's moving markets this week

I feel like I’ve had more than my money’s worth from the phrase “The most important week for markets since…” But, as weeks go, this one is right up there.

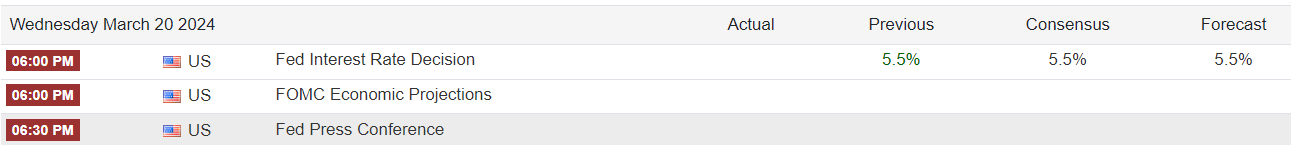

On Wednesday, Jerome Powell and the lesser-known voting members of the Federal Open Market Committee (FOMC) will update the market on the future path of interest rates.

What’s significant about this meeting is that for the first time this year, markets expect just three interest rate cuts in 2024. This is also the first time the market is aligned with the latest Fed guidance. Bear in mind that it wasn’t too long ago that the market was pricing SEVEN rate cuts in 2024 with rate cuts beginning this month. Of course, inflation data has turned materially higher since then. As such, with interest-rate futures predicting the first rate cut won’t arrive until June.

Whilst three rate cuts in 2024 are certainly more realistic (seven was never going to happen outside of economic collapse), when I look at Oil up 20% this year, and other commodities catching upside momentum, I wonder if even three cuts are optimistic — we won’t have long to find out.

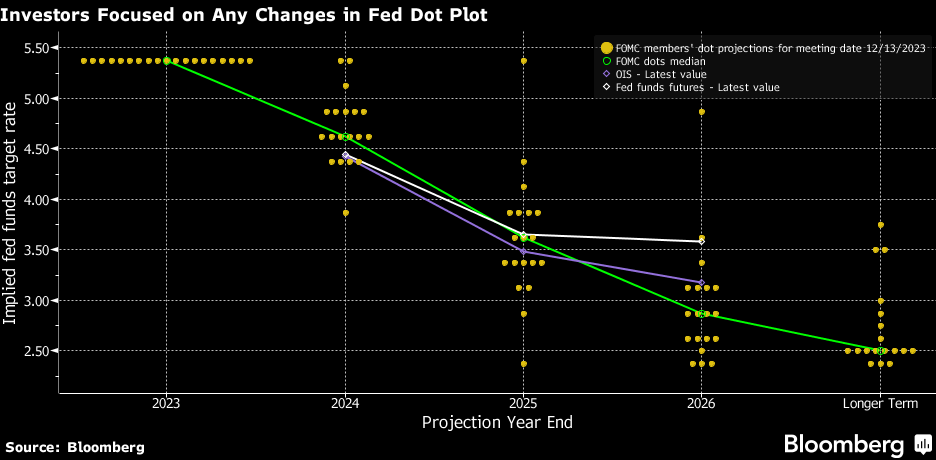

Even though there’s almost no chance the Fed will adjust policy this week, the voting members will update their projections of where they expect rates will likely be going forward (dot plot).

As of the December meeting, the median Fed forecast called for three cuts in 2024. However. The risk for markets is if the dots shift higher to price fewer rate cuts, or if Powell’s presser highlights the recent uptick in inflation as a reason to keep rates higher for longer.

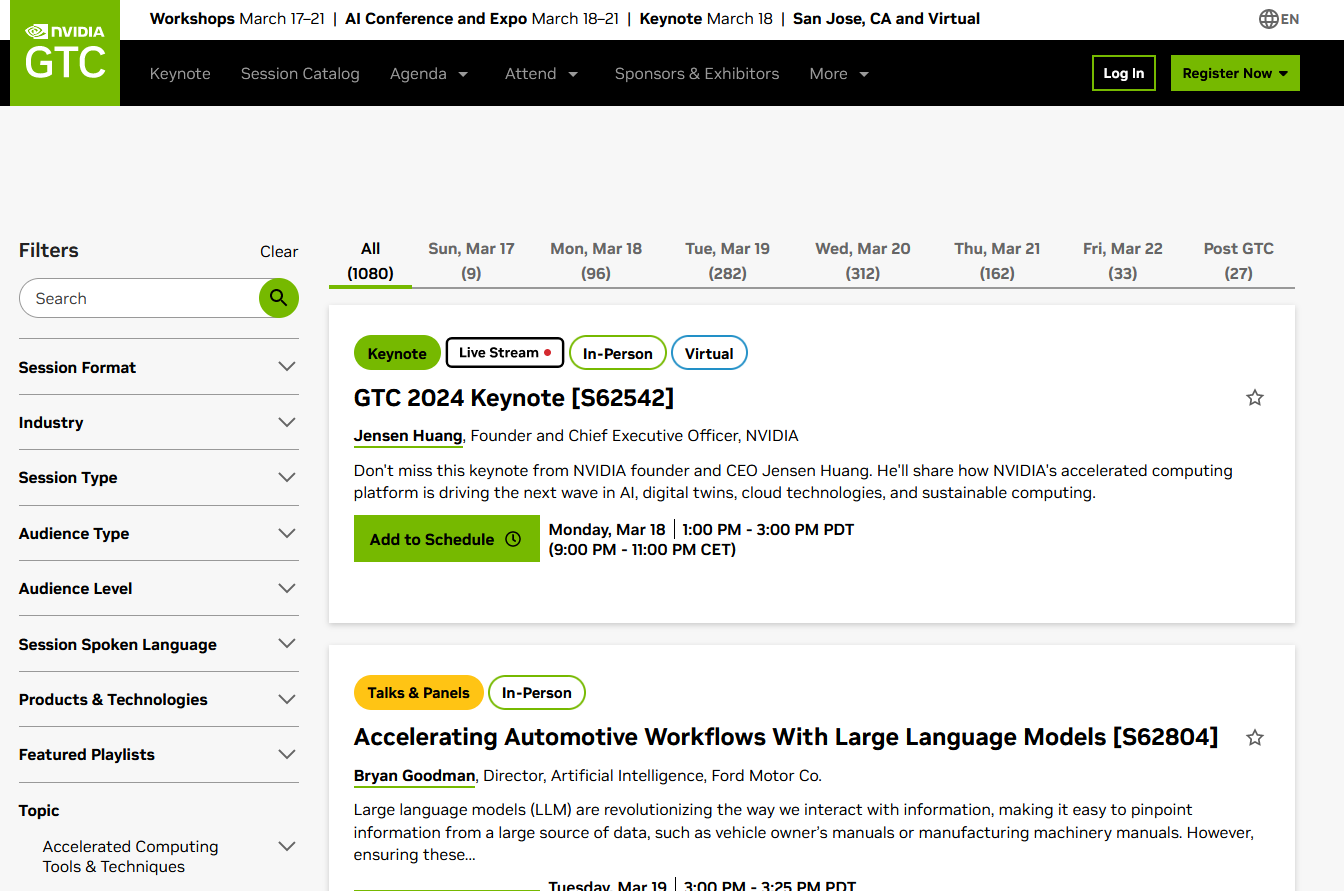

Another big ‘macro’ event of this week is the Nvidia AI conference that kicks off today. The thing is, I’m only half-joking when I say macro because the AI theme has become so dominant, that ‘Nvidia anything’ has the potential to move the market.

Now would an upbeat conference be enough to offset a hawkish FOMC? At an index level, no. But consider the double-whammy of a hawkish Fed and a lukewarm reaction to the conference…How about a dovish Fed twinned with a revolutionary announcement from Nvidia?

The point is that whilst the FOMC should dictate the general direction of stock indices from here, Nvidia could provide the accelerant. This is clearly not lost on the options market, which predicts that Nvidia will see an 8.5% move this week.

The chart shows the 1-week at-the-money straddle (buy call and buy put).

Is there a trading opportunity?

Whilst I’m leaning toward the Fed being more hawkish than the market expects (despite the recent adjustments), I have no real insights into what may or may not come out of the Nvidia conference. That being said, the current market structure provides several attractive trading opportunities.

Here’s why…

Keep reading with a 7-day free trial

Subscribe to Trading Floor Whispers to keep reading this post and get 7 days of free access to the full post archives.