On Monday I laid out my trading plan for the week: Let implied volatility come down and stocks move higher so we could short the market at preferential levels…

Implied volatility might soften in the early part of the week, providing some stability for stocks. If that’s the case, it will provide a golden opportunity to load up on bearish trades before the feeding frenzy towards the end of the week.

Luckily, the market obliged. With the Vix slipping from 20.8% down to 18% and the S&P 50 points higher, the time to get short has arrived.

Why today?

The market has been oblivious to the cracks below the surface for months, but those cracks have morphed into a cavernous sinkhole, too large to ignore.

The Five Red Flags

Bond Yields Breaking Higher 🚩

Gold Breaking Higher 🚩

Oil Breaking Higher 🚩

Volatility Firming 🚩

Big-Tech Wobbling 🚩

Before we get to those, let’s address the 100-pound bull case in the room.

You’ve no doubt seen headlines similar to the one above saying how a tsunami of CTA buying is going to send stocks vertical in the days, and weeks ahead. CTA flows are close to the top of my list of ‘things I’m watching,’ but they need to be taken in context. Systematic selling on the way down was a key factor in the weakness we saw from August through September. But that’s only because the S&P moved into negative gamma meaning market-makers were also selling on the way down. Presently, market-makers are selling into strength in increasing size to hedge against the large call open interest around 4400.

The expected CTA flows via Goldman:

Over the next 1 week…

Flat tape: $30bn to buy ($17bn SPX)

Up tape: $77bn to buy ($35bn SPX)

Down tape: -$4bn to sell (+$2bn SPX to buy)

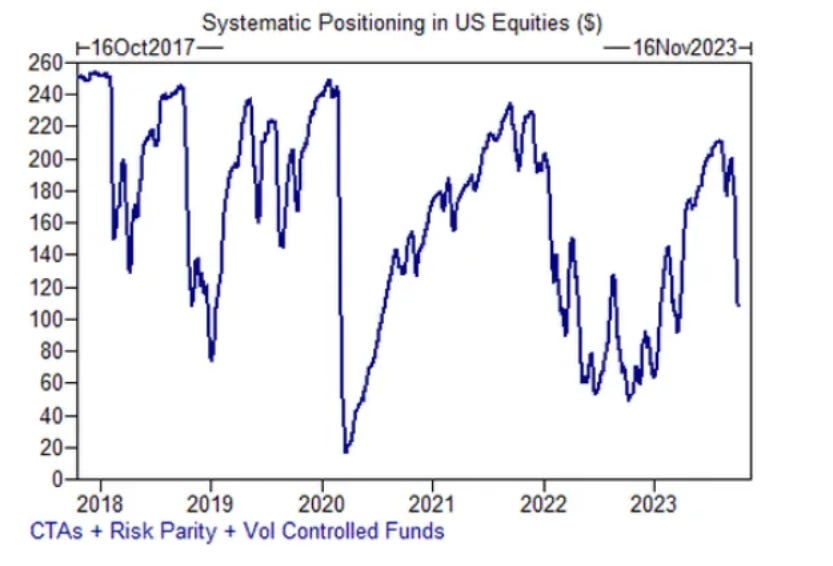

A couple of things to consider. First, it’s already Wednesday so 2/5 of that buying is presumably done. Second, while noteworthy, CTAs are minnows in comparison to other market players like hedge funds, mutual funds, and pension funds. They’re not even the largest cohort among the systematic crowd.

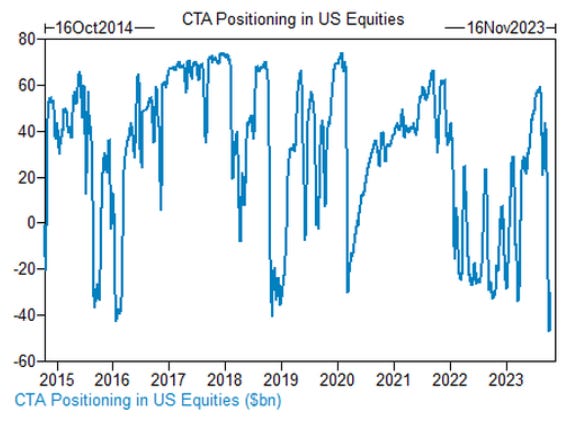

Trend following CTAs are estimated to be short $40 billion S&P.

However, systematic funds (CTA+Vol-control+Risk parity) are still long overall, especially if implied volatility breaks higher and/or bonds rally on heightened geopolitical tensions.

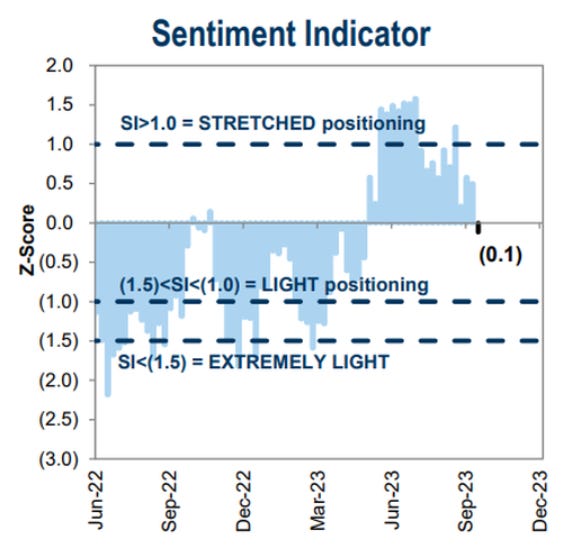

Furthermore, the GS Sentiment Indicator, tracking investor positioning across more than 80% of the US equity market, suggests sentiment has only just turned negative.

Now to the red flags

🚩Bond yields

The strong US retail sales print yesterday sent bond yields surging, with the 2,5 and 10-year all touching highs last seen before the Great Financial crisis. Notably, the TLT 20+ year Treasury ETF is close to breaking down below the recent lows. This is not bullish for equities.

🚩Gold bursts through major resistance

This morning gold has cleared the 100 and 200-day moving averages and the upper end of the descending trend channel on mounting fears of a wider conflict in the Middle East.

Developing….

🚩Crude Oil holds key resistance and bounces

WTI crude traded is up over 3% this morning to the highest price since the start of the Israel-Hamas war. At the risk of repeating myself: oil is the most important chart for markets right now. Not only will it react to escalations faster than equities, but it also sets the tone for US inflation.

Developing…

🚩Voltility is Waking up

Compared to Oil volatility (top) and bond Volatility (middle), the Vix (bottom) has hardly reacted to recent events. Similar to last week, I expect to see equity volatility trade materially higher towards the end of the week as new hedges are placed ahead of the weekend. Only this time I think equities will react.

Take into account the potential selling from vol-controlled funds if the Vox clears last week's high of 20.88.

Developing…

🚩Big Tech Wobbling

Yesterday’s price action in Nvidia was a wake-up call for over-complacent bulls that the market darling can also go down. The stock sank 7% in early trading after the U.S. Department of Commerce announced plans to curb the sale of more artificial intelligence chips to China.

NVDA slid below the 100-DMA and the rising trend support before paring losses late in the day, recovering the key support levels. However, I expect the next leg down will not be so forgiving to the bulls. And when Nvidia cracks, big tech will follow, and when big tech cracks, the whole market cracks.

Developing….

While we hope for the best, here are three trades to prepare for the worst!

Keep reading with a 7-day free trial

Subscribe to Trading Floor Whispers to keep reading this post and get 7 days of free access to the full post archives.